С наступлением лета переход на летние шины может значительно улучшить ваши впечатления от вождения.

Когда речь заходит о строительных и отделочных работах, крайне важно уделять внимание качеству и

Серед різноманіття варіантів оформлення стель натяжні полотна не втрачають актуальності з моменту їх появи

Затеняющие сетки — это незаменимый инструмент для садоводов и огородников, которые заботятся о своих

Ножовки – незаменимый инструмент для работы с деревом, металлом и другими материалами. Среди множества

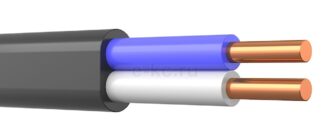

У світі кабелів ВВГ посідає особливе місце. Не просто набір букв, а символ цілої

Ремонт побутової техніки — справа відповідальна і потребує професійного підходу. Адже від якісного ремонту

В современном сельском хозяйстве эффективное хранение сельскохозяйственной продукции является одним из ключевых факторов успеха.

Плиткорезами называются устройства для резки кафельной плитки, а также гранита, керамогранита и прочих облицовочных

Довідка про несудимість є документом, що підтверджує відсутність судимості у громадянина. Цей документ може